- Home_

- Knowledge_

- Good Reasons to Celebrate the New Year

Good Reasons to Celebrate the New Year

It is great to be back at work.

Three weeks holiday was perfect. Time now to get back into a routine. People to catch up with. Promises to keep. Things to do.

I thought a brief catch up on markets was called for to remind ourselves what was happening at the end of last year, and then we have two further items of good news to share with you.

What happened to investment markets over the break?

At the end of 2024 markets were going ahead nicely, at least until the end of the first week of December. The prospect of lower interest rates in the US and the dream of Artificial Intelligence making riches for us all, created a sweet spot for global markets, all off the back of the vibrant US environment.

Prior to Christmas there were worries about the US economy being too strong, with inflation coming down slowly but employment staying high. All things that a rational member of society would want, but for the markets that wasn’t what they were expecting.

For interest rates to keep coming down (what we all want) there would need to be evidence of a slowing US economy. Lower interest rates is what the market is expecting and lower interest rates have already been built into share values.

Two pressures came to a head in the first two weeks of the new year:

- US employment figures came in strong … woops, perhaps the US would not be lowering interest rates as quickly as expected if the US economy was doing that well, and

- Donald Trump’s claims of what he was going to do on the first day of his presidency were looming and looking inflationary and that didn’t auger well for bringing interest rates down either.

Portfolios lost up to 0.5% in those first two weeks of 2025.

Since then, nearly a week later, portfolios have recovered, up 0.5% to 0.8% since 1 January 2025. And there is a bit more to come in the pipeline from last week.

Suddenly the Trump changes don’t look so bad, maybe even good for some US companies.

From now on it will be all eyes on Trump. Over the short term we will ride on his coattails (what will be, will be) knowing that over the medium to long term we are riding on the back of the world economy and the resilience of people going about making their lives better for them and their families.

Improved banking with your own virtual bank account at ANZ

We have joined the banking revolution partnering with your custodian FNZ Custodians, ANZ Bank, and Consilium to bring you your own unique bank account at FNZ for the depositing of new investment monies.

This means that your deposit arrives directly into your portfolio Cash Account and investment can begin immediately.

This simplifies the process and speeds up the investment of your money. Faster and simpler, an outcome welcomed by all.

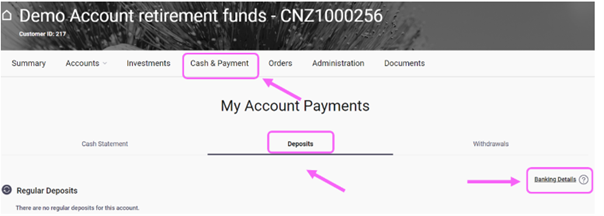

Next time you are on the Consilium platform you can find your virtual bank account number for future deposits by following the diagram below.

Before you make your next deposit, contact your adviser and we can help you through the process.

Administration fees have come down from 1 January 2025

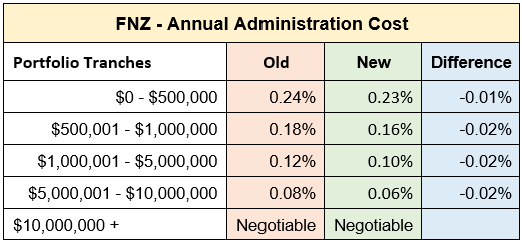

phwealth have negotiated with FNZ Custodians to reduce the FNZ Administration fee as follows:

For a $1m portfolio this equates to a saving of $150 per annum.

For a $5m portfolio this equates to a saving of $950 per annum.

For larger portfolios the saving is greater while for smaller portfolios the saving is less.

We are always looking for ways to reduce your costs and look forward to more good news like this in the future.

Get in touch with me, or your adviser, if you wish to discuss any of this. We love hearing from you.

Keep asking great questions ...

related articles.