- Home_

- Knowledge_

- Inflation - the silent thief.

Inflation - the silent thief.

Inflation is here, that’s why you own shares.

We’re not exactly sure of the recipe required to bake fast rising prices into the economy but we’re pretty sure of the ingredients. You will commonly need -

- disruptions in free-flowing trade

- shortages in goods

- surplus money in the economy; such as that provided by financial stimulus packages

Between the effects of Covid-19, logistical challenges, worldwide massive government stimulus and now the war in the Ukraine, accompanied by sanctions, we can easily see why prices are increasing. There is just too much money chasing goods that are becoming rarer and more difficult to acquire.

The effects are everywhere and by no means unique to New Zealand. Petrol prices are up, food prices are up, rental prices are up. Interest rates have also gone up and markets are factoring in more rate increases in the months ahead.

You don’t need us to remind you that inflation is here. But if you own a diversified investment portfolio you are probably already prepared for inflation. So, what do we mean by ‘already prepared’?

It means that unlike many Kiwis, especially many senior citizens, you are not just invested in cash and term deposits which tend to perform poorly when inflation is high. You are instead invested in a range of different assets that, over time, will generally do much better than inflation.

Just recently we were told a story of a conversation one investor had with her friend Mary, who is widowed and lives in a retirement community. Mary commented that she was worried about running out of money.

“Okay Mary,” the investor asked, “what’s your financial situation look like?”

“Well,” Mary said, “I’ve got a little less than $100,000 and it’s all in a savings account in the bank.”

“Why do you have everything in the bank Mary,” the investor responded.

“Because it’s safe….”

Mary may have thought investing in the bank was safe, and perhaps it is safe… from criminals. But if there’s one thing that demonstrates that investing in cash is not safe, it’s the corroding effects of inflation.

As we write this, inflation according to the Reserve Bank of New Zealand, is at 5.9% (Q4 2020 through 2021 Q4). But even that doesn’t tell the whole story. It’s widely reported that in Q1 2022 inflation has progressively worsened.

The graph below from Stats NZ shows that inflation is currently at its highest rate in over 20 years.

It’s clear from this data that someone like Mary, earning very little on her bank savings, is in a poor position. Her $100,000 is very precious and the amount of goods, services and daily necessities it can purchase is reducing every day.

Inflation has accurately been described as a silent thief. If Mary’s savings are earning an average return of 1.0% p.a. (before tax and fees) but the cost of the critical goods and services she needs to buy is going up by 5.9% p.a. (or more), then you can quickly see her purchasing power is eroding fast. By contrast, our clients very rarely have the majority of their assets in cash. Extra cash is held for short term, definitive purchases. Future purchases, which are the ones most influenced by rising prices, are generally funded through a portfolio.

Figure 1: New Zealand Annualised Inflation

Source: Stats NZ. Notes: Latest data (Dec quarter 2021)

Source: Stats NZ. Notes: Latest data (Dec quarter 2021)

Although a portfolio’s value can go up and down, it typically provides good insulation from the long-term effects of inflation for very logical reasons. If the prices that businesses charge for their goods and services increase, so do their nominal revenues. Over time, that increase in revenue pushes up the value of their share prices.

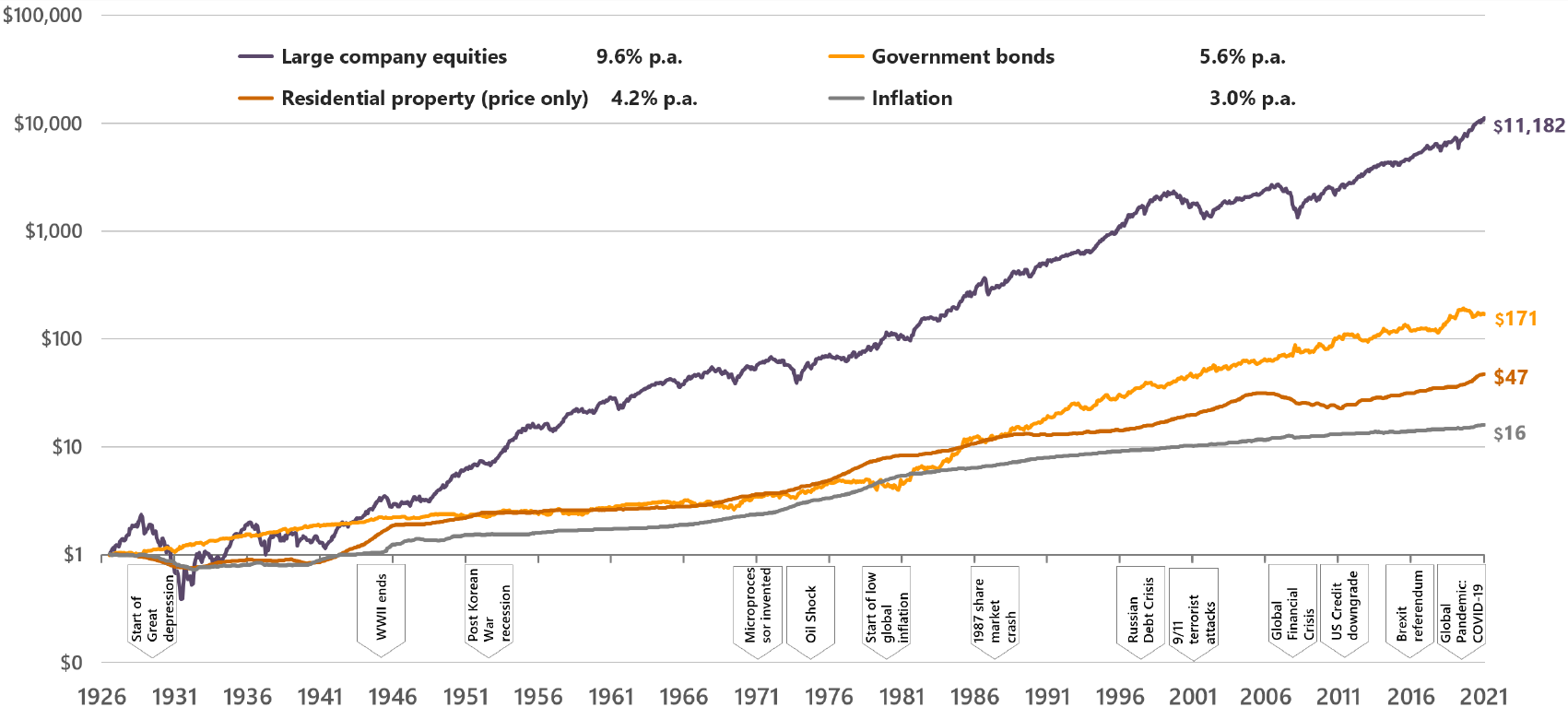

Shares, unlike cash, have a long history of outperforming inflation as the chart below demonstrates. It shows inflation in the United States back to 1927 and the data tells us that $1 in 1927 was worth the same as $16 in 2021 (i.e. $1 adjusted for inflation each year). However, $1 invested in large US companies was worth $11,182 by year end 2021 before tax and costs. Other assets also outperformed inflation over this period, including bonds and residential property, although not by as much.

The main point, however, is that an investor that owns a diversified portfolio of shares, some bonds and property, is already well positioned to withstand inflation over any reasonable time horizon. And for that reason our investors (unlike Mary) should feel comfortable.

What about alternative investments?

We are sometimes asked about other securities that are promoted to reduce the effects of inflation. The one brought up most often is commodities. In case you were curious, commodities present three main challenges within the context of a portfolio:

- They are traditionally dominated by energy products such as oil, which environmentally conscience investors want to avoid.

- Commodities are very price volatile; about 20 times as volatile as inflation itself. Trying to dampen inflation with something 20 times more volatile is like cracking a nut with a sledgehammer. It could get messy.

- The long term returns of commodities are usually only 3% to 4%, just a little more than the return on inflation itself.

We aren’t sure how much longer inflation will be with us. The answer may depend on being able to predict Covid-19 mutations, the geopolitical moves of Russia, the counter measures of OPEC and NATO, and Central Bank policy - all at the same time. However, we are sure that inflation will show over time, the wisdom of owning a portfolio as opposed to other ‘safe’ alternatives, such as cash.

In today’s environment, losing purchasing power with cash is inevitable.

Even though we can’t predict the future, history tells us that beating inflation over the long term in a prudently diversified investment portfolio, is probably also inevitable.

Figure 2: Long term growth of wealth - shares, bonds, bills and inflation 1927 - 2021

Source: Consilium Graphica 2022. Notes: Analysis period is for June 1927 to December 2021. All returns are in US dollars.

related articles.