- Home_

- Knowledge_

- Looking beyond cash and term deposits

Looking beyond cash and term deposits

New Zealanders hold a lot of assets in term deposits. $165 billion at last count.

Some investors prefer the stability that term deposits provide, but investing in term deposits exposes you to other risks which are sometimes less obvious:

- Liquidity - You need to provide 31 days written notice to break or close your term deposit and it can be costly as you may have to forfeit your interest.

- High Tax - All of the term deposit return is taxed compared to shares where capital gains are not taxed.

- Concentration risk - This is where you put all your term deposits with just one bank, rather than spreading your deposits around in multiple banks.

Another problem with term deposits is they will struggle to keep up with inflation over the medium to long term. For short term money, up to say 18 months, term deposits may be a safe ‘holding place’ but term deposits are not the place for your long-term money.

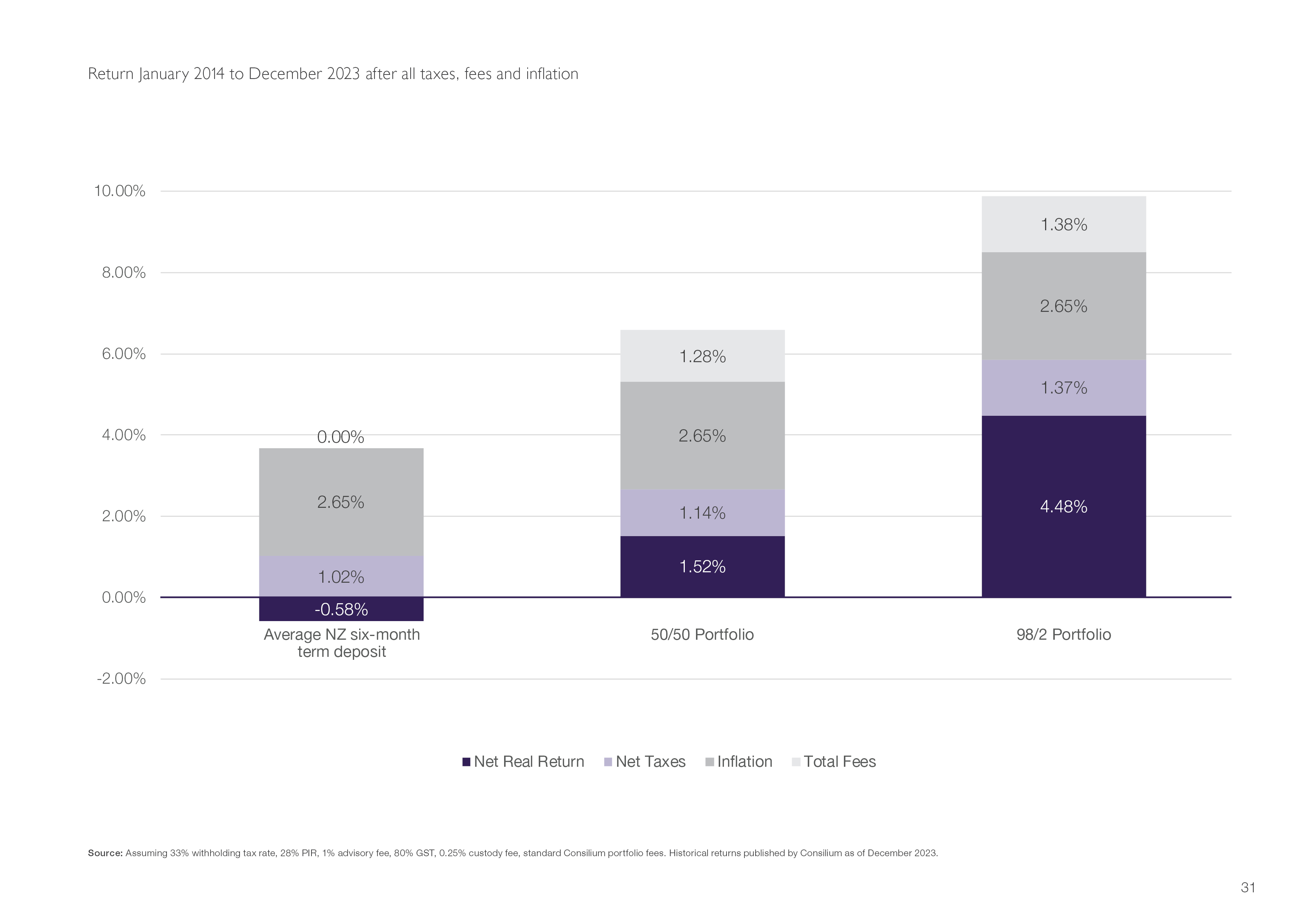

Over the past 10 years, after tax and inflation the real return of a six-month term deposit in New Zealand is negative at -0.58%. So, for the $165 billion of term deposits they are collectively losing almost one billion dollars[1] of spending power.

Analysing the different rates of net real return (which is the return after all fees, costs, and inflation) puts into stark contrast the ability of each of these different investment choices to grow wealth over time in the face of inflation, which is demonstrated in the below chart.

[1] Exact figure is $957,000,000 of lost spending power per year

Figure 1: The benefit of diversifying away from term deposits into globally diversified portfolios which include shares and bonds

The reality is that if you require fixed income to fund your goals, there are smarter ways to create this income than dumping your savings into term deposits. Our globally diversified portfolios contain other ‘fixed income’ securities (we call bonds) and these bond investments produce many of the same benefits of term deposits, but they also offer full liquidity, high diversification, high yields with often superior tax benefits.

If you are sitting on cash in the bank and unsure of what to do, give us a call as there may be a smarter option available for your long-term money, other than the humble term deposit.

Keep asking great questions…

related articles.