- Home_

- Knowledge_

- The Investing Olympics

The Investing Olympics

Which nation will dominate the medal tables at the upcoming Paris Olympics?

Past performance suggests it will be one of a handful of names. But when it comes to World share markets, country performance is much harder to predict.

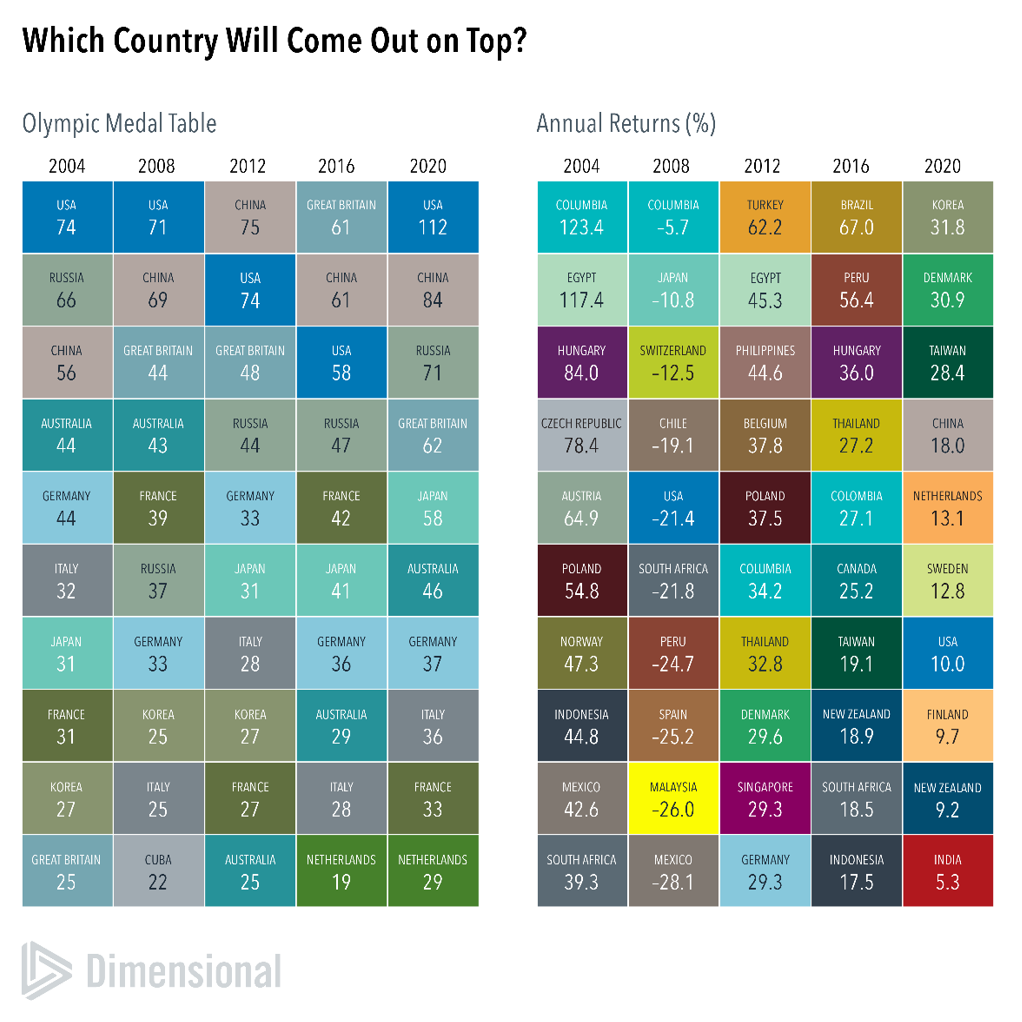

Regular Olympic watchers will know the biggest medal hauls are traditionally won by one of a select few nations. Since 2004, for instance, our exhibit shows the USA has appeared at the top of the overall medal table on three occasions, and second or third on two occasions. Other G7 nations and Russia usually feature near the top, although Australia has punched above its weight, placing in the top 10 in all the summer games in the past two decades.

In world share markets, however, past performance is no guarantee of future performance. The panel on the right of the exhibit shows annual returns for various developed and emerging market countries for the year of each summer Olympics since 2004. Whether you assess it from one Games to the next or from one year to the next, it is hard to see any discernible pattern.

This means that while you may have a favourite country at the Olympics, when it comes to investment it makes sense to have a globally diversified portfolio. That way, you don’t need to predict which countries will deliver the best returns year to year. Holding stocks from around the world allows you to capture the top performers wherever they appear.

Interesting to note that New Zealand doesn’t feature in the top 10 countries from an Olympic medal count, but it does feature in the top 10 for share market performance, twice, in 2016 and 2020.

The world share market offers exposure to more than 13,000 companies in more than 40 countries. As the gap between the best and worst-performing countries in any one period can be significant, a global portfolio helps mitigate country specific risk, helps narrow the range of outcomes and can help improve reliability of returns.

Best of all, being globally diversified allows you to stop worrying and enjoy the games.

Warwick Schneller, PhD, CFA, Senior Investment Strategist and Vice President, Dimensional Fund Advisors

related articles.