- Home_

- Knowledge_

- The power of dollar cost averaging

The power of dollar cost averaging

Without a crystal ball, it is impossible to correctly estimate future market trends, not to mention the best time to invest. If investors wish to reduce volatility and benefit from long-term growth when markets move up, or down, regular savings can prove very beneficial.

In recent years we have seen a fair amount of volatility in financial markets. Although this can be difficult to watch from the sidelines it can prove to be very rewarding for long-term savers.

Those who save a regular amount every month should love it when the market goes down, precisely because their monthly savings will buy them more investments when prices are low, compared to when prices are high.

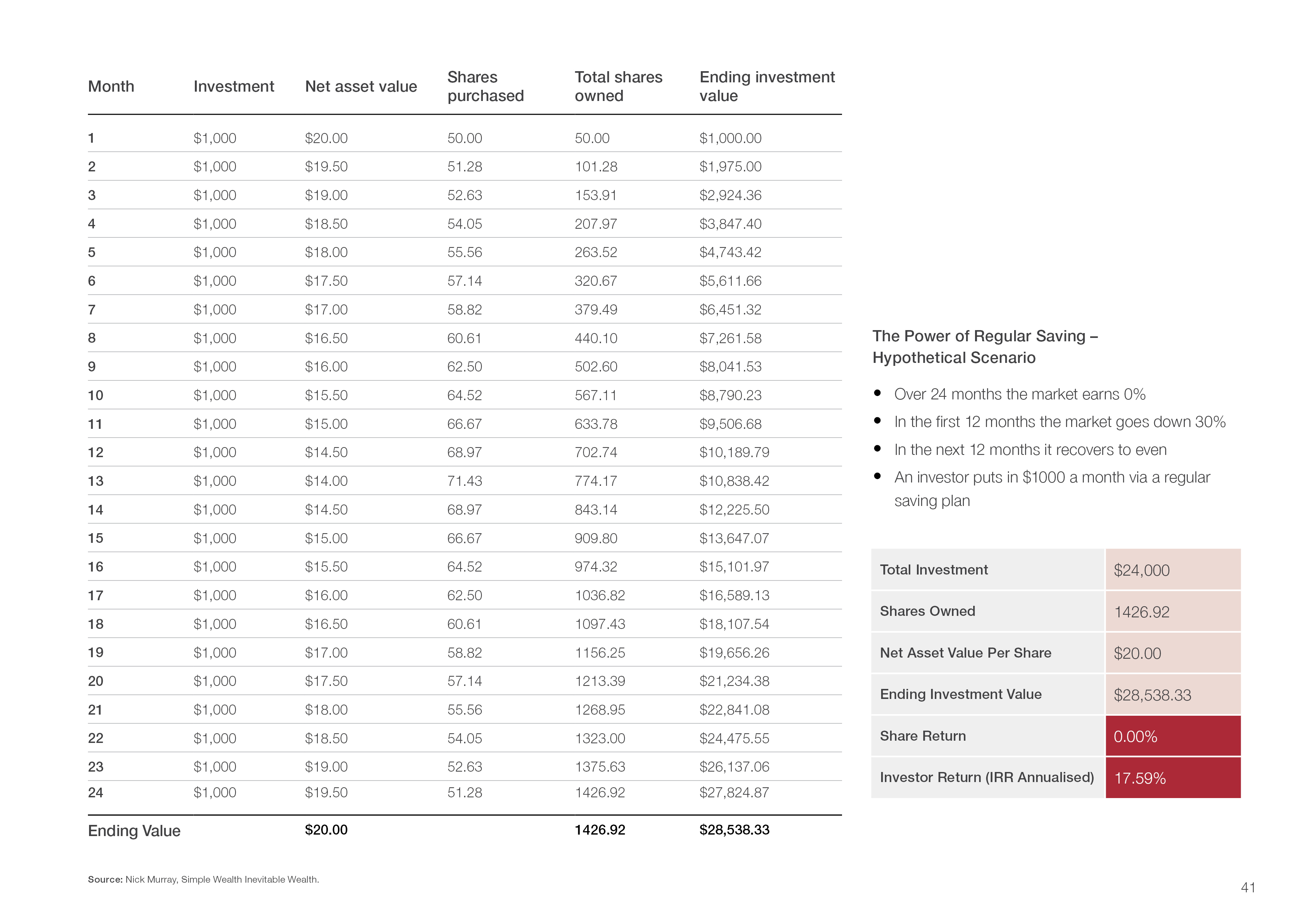

To illustrate this, we provide a hypothetical example. Our investor purchases $1,000 of a growth fund each month. In the first 12 months the price of the fund falls by 30% and in the next 12 months the price recovers to its original value.

At first glance, you would think that given the price was flat overall, investors wouldn’t make anything on their investment.

But you’d be wrong. Our calculations show that the investor would have made a return of over 17%.

How?

That $1,000 deposit purchased more investments at low prices and less investments at high prices. By investing each month investors automatically purchase more investments when prices were at the lowest levels. When prices recovered to even, the average price the investor paid was lower than the final market price and therefore this translates to a handsome return

If you regularly save into your KiwiSaver or investment portfolio, market swings can help you to achieve higher long-term returns.

Volatility is the friend of the regular saver.

related articles.