- Home_

- Knowledge_

- The Randomness of Returns

The Randomness of Returns

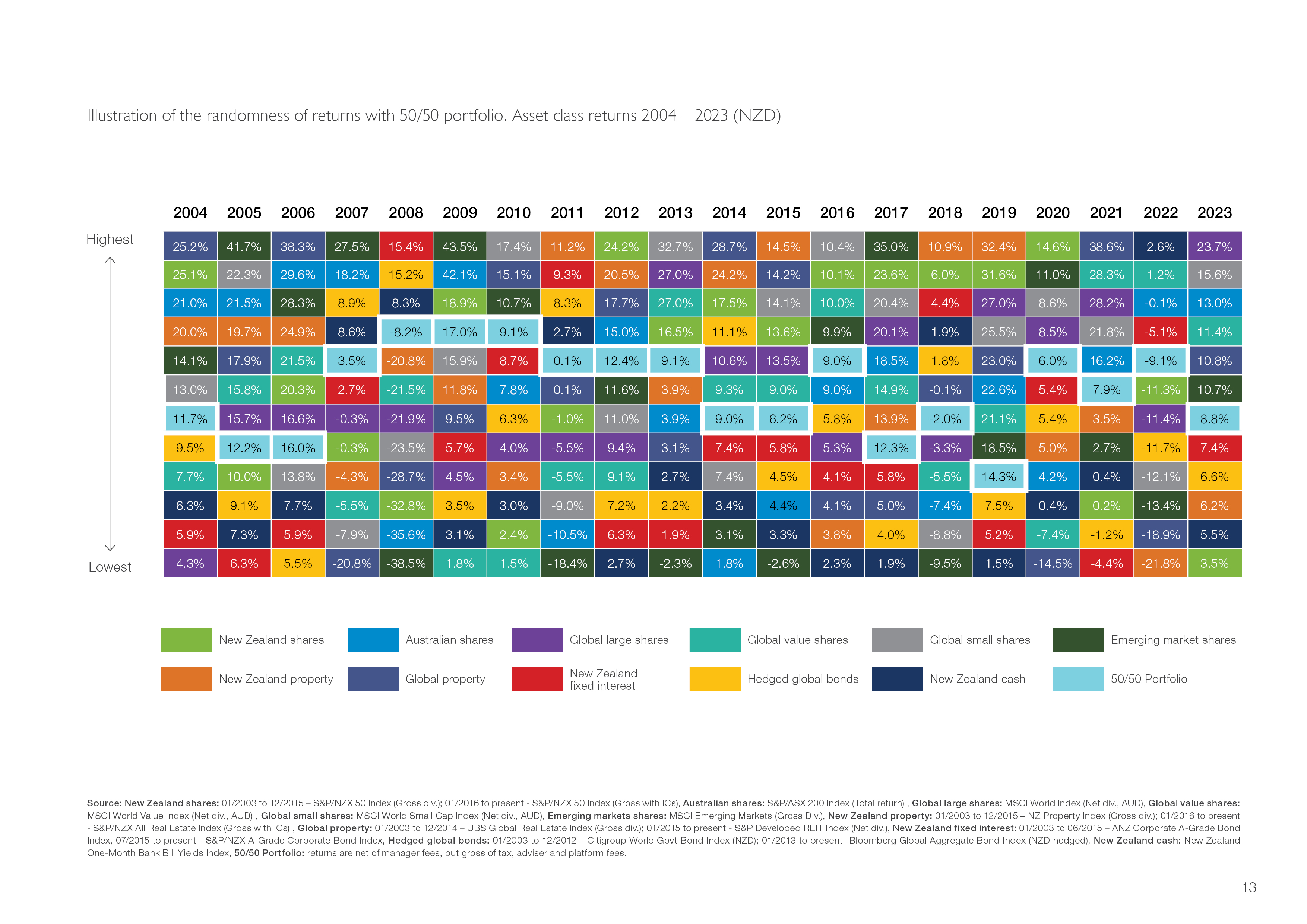

Market returns can often feel like a rollercoaster – unpredictable and constantly changing. In this article we dive into the importance of diversification and why spreading your investments across different investment sectors is key to long-term success. Using a vibrant table of returns from the past 20 years, we show how difficult it is to predict the top performer each year.

This is one of my “go-to’s” when describing how random returns can be. You know the saying “a picture paints a thousand words” and I believe the same holds true for the table below. It provides a colourful illustration of how various types of investments (asset classes) have performed over the past 20 years, alongside the returns of a Balanced 50% Growth/50% Defensive portfolio. Much like a patchwork quilt—colourful and varied – yet with no clear pattern from year to year.

Predicting which investment sector will top the charts each year is impossible. Trying to “pick the winner” can just as easily result in picking an underperformer. For example, in 2023, Global Large Companies were the best performers, a title they hadn’t held in the previous 20 years! Similarly, New Zealand Shares, which dominated the top spot in 2020, had not held that title since 2012 and hit the bottom in 2023. This unpredictability is a reminder of how difficult it is to “pick the winner” in any given year.

Why Diversification Matters

Let us take a real-life example of why diversification is essential – the Global Financial Crisis (GFC) in 2008. During that year, nearly every share market around the world took a big hit. For instance, New Zealand Shares and Australian Shares both dropped dramatically, while Global Property plummeted by over 35%. However, during the same period, investments in Bonds (like Hedged Global Bonds and New Zealand Fixed Interest) actually rose, helping to offset the losses in riskier investment sectors (shares and property).

This demonstrates the power of having a mix of investments. Bonds, especially play a crucial role in smoothing out portfolio performance during turbulent times. When share markets face downturns, such as during the GFC or more recently during the pandemic’s onset in 2020, bonds have historically offered a stabilising effect. While share markets were plummeting, bond prices were rising as investors sought safer investments. Portfolios that included bonds saw their losses mitigated compared to those solely invested in shares.

By spreading investments across investment sectors such as bonds, shares, and cash, a diversified portfolio reduces the impact of any one investment sector performing poorly. Bonds, in particular, tend to provide stability during market downturns, helping to smooth out the overall portfolio performance when shares are in decline.

Aiming for Steadier Performance

Take, for example, the Balanced 50/50 Portfolio, while it may never reach the top of the performance charts in any given year, it also avoids landing at the bottom. This is why we believe in spreading investments across multiple investment sectors. It ensures your portfolio has exposure to some of the best-performing investments, while reducing the risk of being overly concentrated in the poorest-performing ones.

In 2021, for example, Global Shares surged to the top spots driving strong returns in growth-focused portfolios. But in 2022, rising interest rates and economic uncertainty sent many of these same investments into decline. However, portfolios that included Bonds and other defensive investments were cushioned from the worst of the market volatility.

In the world of investing, it’s often said that diversification is your only “free lunch” and this colourful “quilt” of returns clearly illustrates why.

Illustration of the randomness of returns with 50/50 portfolio. Asset class returns 2004 - 2023 (NZD)

related articles.