- Home_

- Knowledge_

- Treat the media as entertainment, not enlightenment

Treat the media as entertainment, not enlightenment

For a long time now, I have been vocal in my unenthusiastic opinion of “the news”. When I think back, my distaste for the news started in February 1995. I was 15 at the time and my dad liked to watch the 6pm news and in those days (pre-sky, pre-mobile data, pre-smart phone, pre-internet), the 6pm news was the Campbell family’s go-to on catching up on current events. It was February 1995 when TV1 extended their main bulletin from 30 minutes to 60 minutes! Crickey, double the news! Something important must be happening?!

(Spoiler alert: there were no more important announcements, cats stuck up trees, terrible public interviews on the street which show one person agreeing with the [insert any random subject here], one person disagreeing, and one person unsure).

Why did TV1 news do this? The simple answer is they could now sell twice as much advertising to a captured audience who had turned the 6 o’clock news into a well-practiced nightly habit. Business was good for those selling advertising space!

What about newspapers? Again, the people that produce newspapers are in the business of selling advertising space. Sell the ads first then fill in the blank spaces with “news” stories that will keep the punters coming back day after day! And bad news sells better than good news.

So, what about the financial media? The news media is full of investment tips. Sadly, by the time we read or watch the news, market prices have already quickly assimilated the new information into current prices. The share market is incredibly efficient at pricing in new information.

So, why then do the creators of news content feel they need to interview (so called) experts to predict what investment markets will do in the future? Financial prediction (or forecasting) is a popular tool in the news content arsenal. Why is this? Well, predictions are easy to make and easy to print and very rarely do people who make the financial predictions get called to task when their predictions turn out to be false. It is very easy to explain a failed prediction by simply saying “due to unforeseen circumstances that risk (or opportunity) didn’t eventuate”. The news editor isn’t fired for printing a bad prediction. Economists aren’t publicly humiliated for getting their predictions wrong. In fact, we joke about economists forecasting abilities – economists predicted 11 of the last 3 recessions!

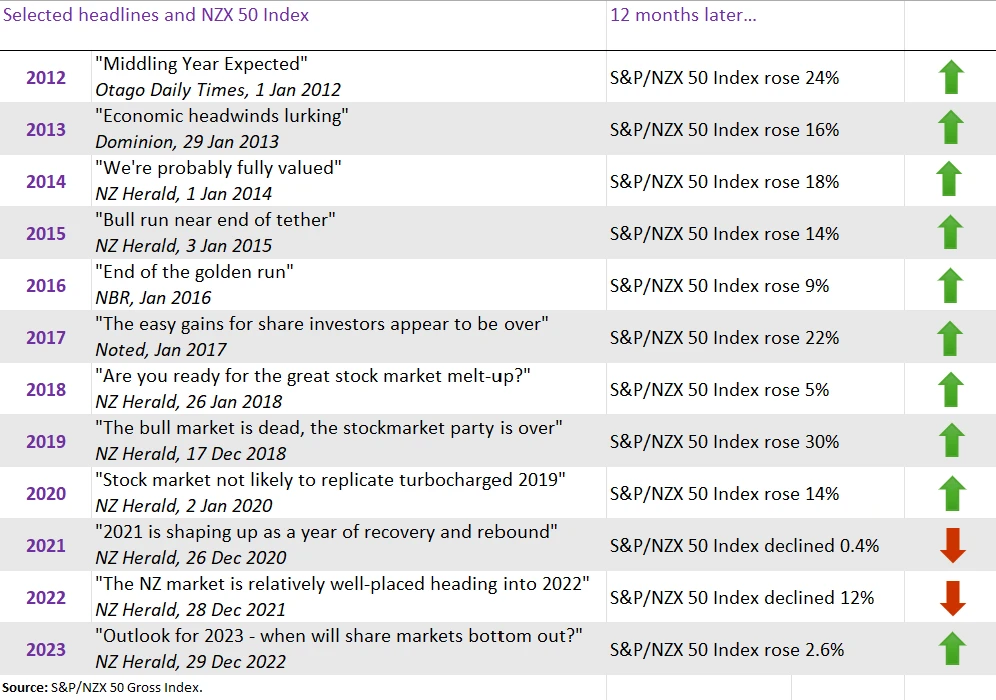

For fun, we looked at some of the financial media’s forecasts and then checked back 12-months later on to see how well they did…. Below are some great click-bait headlines. Not a lot of substance to those bold predictions!

related articles.