- Home_

- Knowledge_

- Why is there no Lionel Messi of managed funds?

Why is there no Lionel Messi of managed funds?

Lionel Messi coolly placed the ball on the penalty spot. He had every reason to be confident in that moment. He had, after all, scored 793 goals, and supplied 250 assists in his professional career. That's 72 minutes on average per goal contribution – more than one a game.

Nothing in his career would mean more than these next few seconds. He had already scored twice in the final of the World Cup and brilliantly assisted the third. A whole nation held their breath. Unlike players that tried to convert penalty kicks with power, Messi has learned he merely needs to kick the ball calmly to where the goalie isn’t. His stuttered approach to the ball is really an attempt to wait until the very last split second to decide where to place the ball. French goalie Hugo Lloris flinched first to his left. It was the break Messi was waiting for. He guided the penalty to the opposite corner.

GOOOAL!!!

Glory.

You may or may not be an international football fan. Maybe you confuse FIFA with the Fertilizer Industry Federation of Australia. But no matter who you are, you can be impressed with a player like Lionel Messi who has been so consistently great for so long. Even if you’re French, you’d have to tip your cap to Messi’s incredible career.

It's Messi’s persistent greatness that we can use as a relevant contrast to the complete lack of persistent greatness in the arena of investment management.

Messi was of course splendid at the 2022 Qatar FIFA World Cup, and football commentators all over the world were not the least surprised. Messi, 35, has been great for many years. As proof of this, look at the FIFA annual awards for the best male footballer in the world.

In the last five years, Messi was named the top footballer in 2019. He came second place twice and once third. In 2018, Messi was ranked in fifth place. This is impressive considering there are 130,000¹ professional football players worldwide, as estimated by Statista.

The reason Messi performs so well year after year is because of his astounding skill, mental toughness and hard work. And those attributes persist. Skill especially persists in football, chess, tennis and many other disciplines. It’s normal and intuitive to count on skill to persist.

Given this, you would naturally assume that in the world of managed funds, the best approach would be to find a skilful manager, e.g., the 'Lionel Messi of managed funds!' It would be intuitive to think finding a manager like that would greatly improve your chances of investment glory.

However, we’d argue such an approach is doomed to mediocrity or worse, failure.

Here’s a curious fact. In the world of investment management, skill, defined as manager led outperformance against a relevant benchmark, doesn’t persist. Let’s look at how we can justify that statement, and then outline the approach we take to selecting investment managers for your portfolio.

What proof do we have that in the world of investment management skill doesn’t persist? The best data comes from the United States.

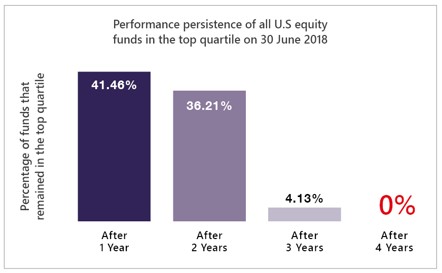

In the United States, index provider Standard and Poors (S&P), has developed something called the Persistence Scorecard to study the persistence of investment performance by managed funds². S&P's Persistence Scorecard tracks the percentage of U.S. equity funds that remained in the top-quartile (25%) or top-half (50%) of equity fund rankings over five-consecutive annual periods (through mid-2022).

In their latest report, S&P researchers highlighted a few key takeaways. Those included:

- Among all actively managed funds whose performance over the 12 months ending June 2018 placed them in the top quartile with their respective category, "not one fund in any of our reported fixed-income and equity categories remained in the top quartile in each of the four subsequent one-year periods ending in June 2022.”

- Over a five-year horizon "it was statistically near impossible to find consistent outperformance."

Look at the graphic above which substantiates the statements from S&P.

You might assume this was a US only phenomenon, but S&P has found the same results in every country it tests. That includes Australia³ where S&P concluded, “Over a five-year horizon, it was statistically near impossible to find consistent outperformance,” for an Australian fund manager.

This lack of persistence is quite the contrast to Messi who was in the top 0.0038% for five consecutive years!

What’s going on? Why is there such a lack of persistence amongst investment managers but such great persistence from the likes of Messi?

There are several reasons that investment manager performance doesn’t persist:

- Even playing field: The net outperformance of all managers in the market is zero. Losers evenly offset winners and no one wants to lose this game.

- Competition: The losers go out of business. The skilled managers that remain and go into competition with each other, eroding each other’s advantage. Some winners must subsequently become losers. The cycle repeats.

- Cost: Managers with skill naturally charge higher fees and those fees offset the benefit they can bring to investors.

- Bloating: Managers with skill often end up with more assets than they have good investment ideas, watering down their skill.

- Luck: Many managers that initially look skilful are often just lucky. Statistically you need about 30 years of returns to distinguish luck from skill. It would be rare

that a manager with skill stayed with one fund for 30 years. - Flawed measurement: Managers that boast skill often compare themselves to a benchmark with different risk attributes to what they invest in. Once you use an accurate benchmark, much of what looked like skill just melts away.

The Persistence Scorecard shows that outperformance is typically relatively short-lived, with few funds consistently outranking their peers.

If that’s the case, then how do we go about selecting funds for a portfolio? The answer is to look past manager performance and identify the key characteristics of funds which have been academically proven to provide higher returns over long periods of time. The main characteristics that affect long term performance are:

- The types of assets the fund owns – for example New Zealand shares

- How diversified is the fund

- The cost of the fund

- The average size, price and profitability of the underlying businesses the fund owns

- Does the fund keep the above attributes consistent over time

- The tax liability of the assets the fund owns

Although none of the above might sound as attractive as finding a ‘Lionel Messi’ fund manager, over time these types of investment characteristics, if held calmly and (here’s our buzz word) persistently by investors, can yield excellent results.

This is the type of persistence that really matters.

related articles.